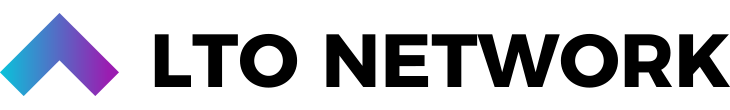

LTO V2.0 Deflationary Fee-Burn Token Economics. DeFi and P/E married with B2B and enterprises.

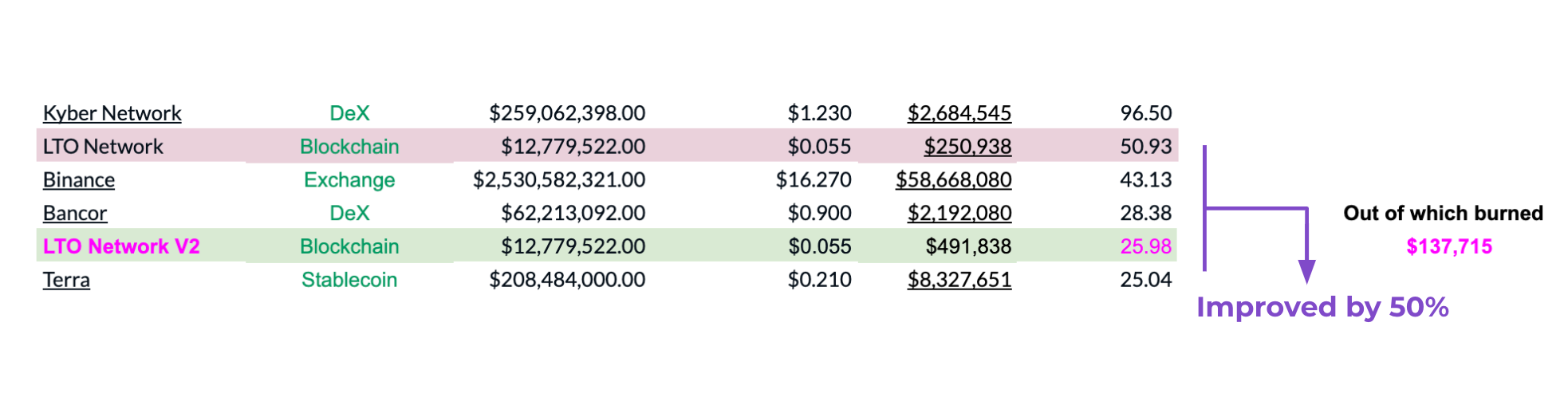

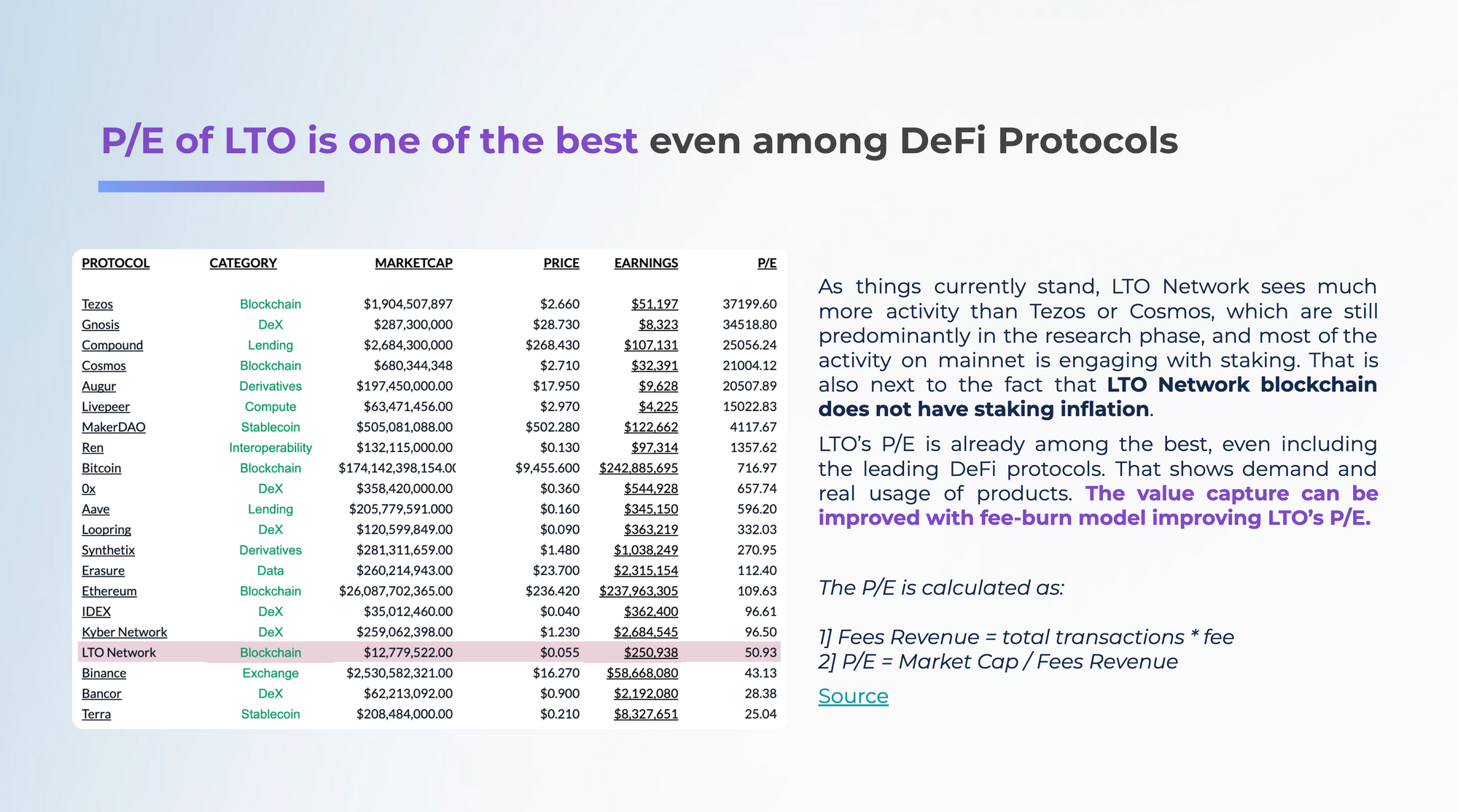

What does LTO Network, blockchain for B2B and enterprises, have to do with Decentralized Finance and Ethereum? In terms of use cases, not much. But there is a lot to learn from successful DeFi projects: Compound, Aave, MakerDao, Synthetix, Kyber. What do they have in common?

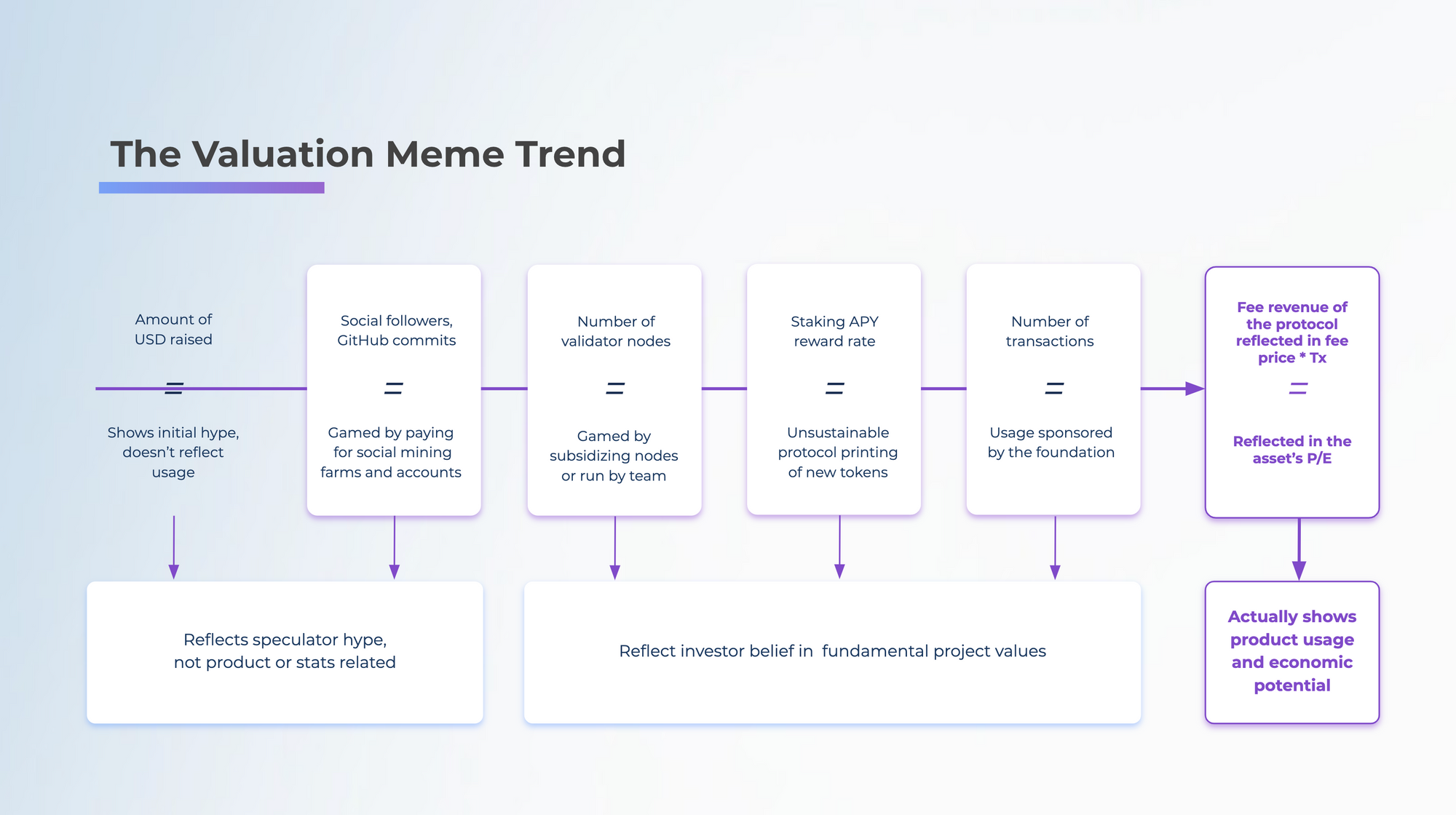

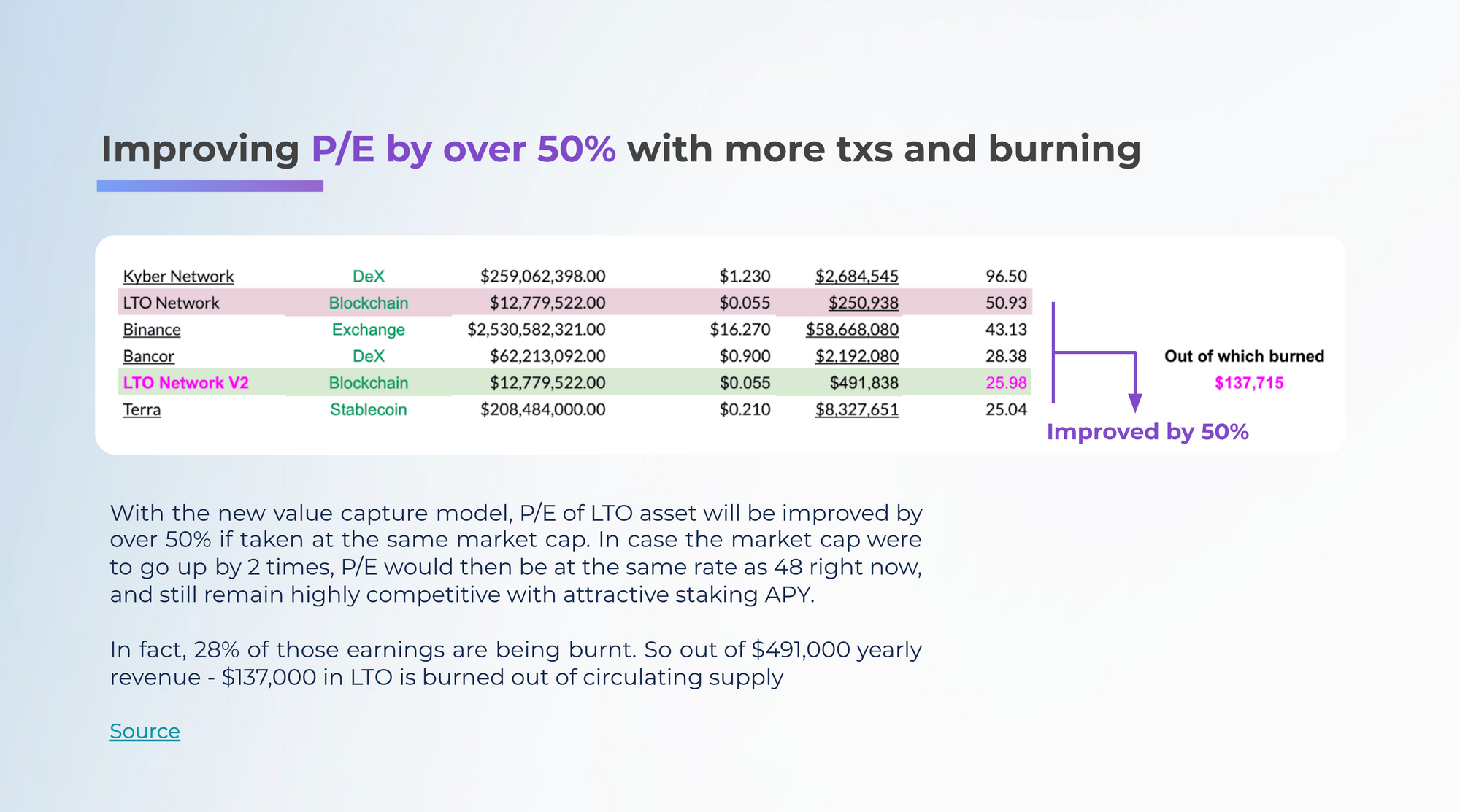

Value capture model. A value capture model can be described as a business model. An example from the real world: subscriptions business model. Whether you have a news website, custom suits, or a food truck - a good business model would work if you adapt it to your clientele. This is what the article is about.

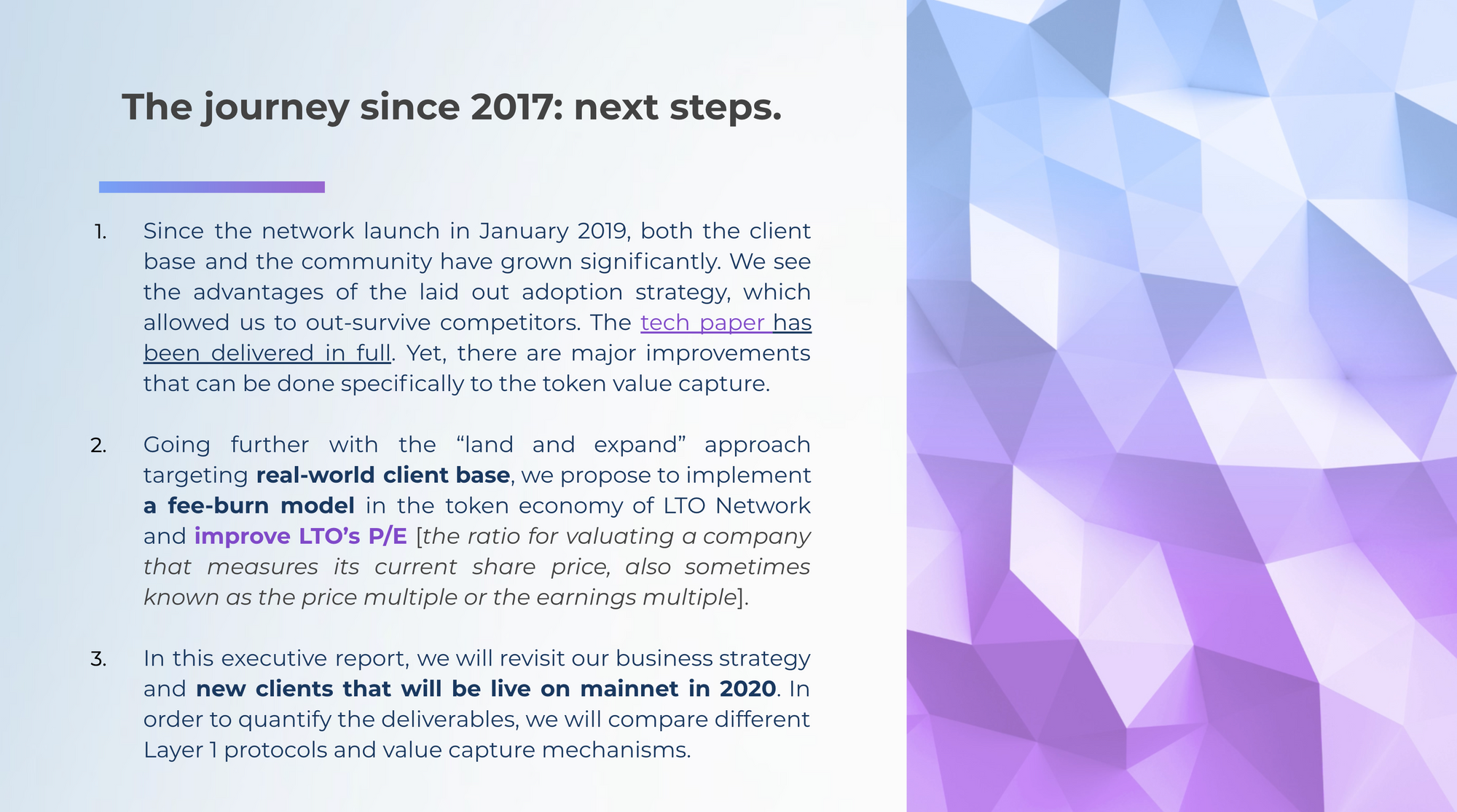

This piece is a collection of slides on the deflationary fee-burn token economics proposal, with comments from the LTO Network core team. If you prefer to see the raw file, you can see this ipfs-hosted PDF. Overall, we are super excited to present you the research and some on-chain stats.

Let's go!

Disclaimer. This is not financial advice or guidance. It is a network upgrade proposal mixed with subjective data, estimations, and projections. Please keep in mind some use cases may be delayed, the usage could potentially be lower, and other risks associated with it. There is no guarantee for price appreciation. If you find any mismatching data, let us know and we will fix it together.

There is no OTC. LTO is tradable on Binance, BitMax, etc.

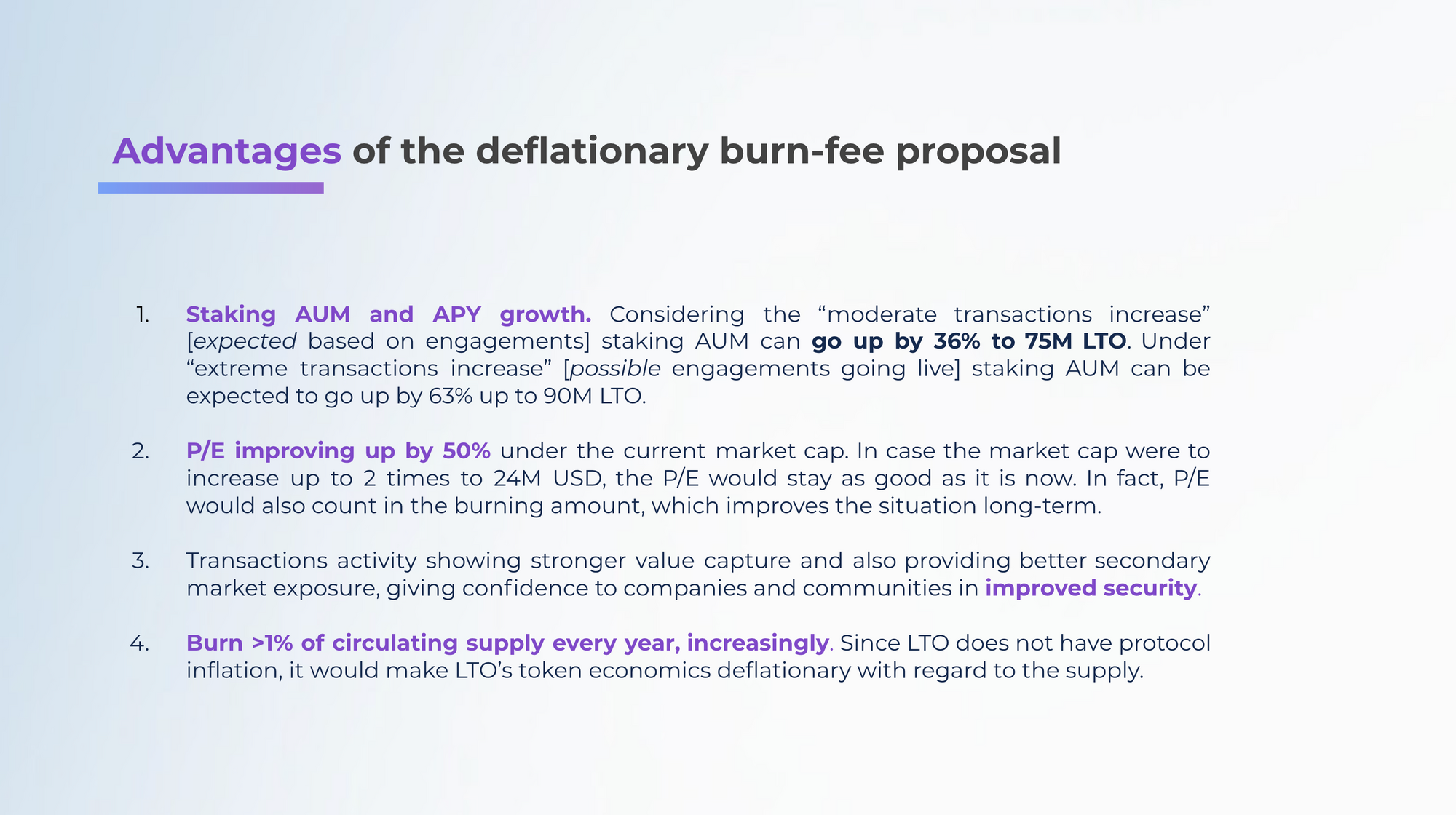

When will the changes go live?

The tentative date for these changes to potentially go live is July 2020, with the vote deciding the future. The changes discussed would simply need another mainnet upgrade vote as was done in 2019 and 2020.

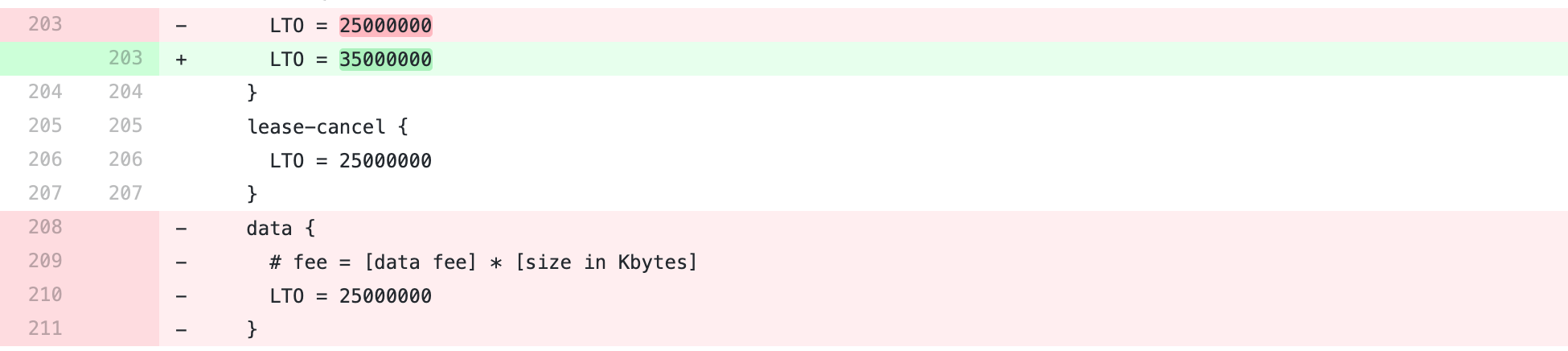

The GitHub changes can be seen and are already on their way. We expect to finish the proposal code changes and test it by the end of July. It is likely that the vote would also be around mid of July. Stay tuned for more news!

Website | Telegram | Twitter | Reddit | LinkedIn | Documentation

Sources and inspiration:

- On-Chain JSON Stats: https://lto.tools/generators/

- Public Blockchain API: https://nodes.lto.network/api-docs/index.html

- LTO Network Use Cases: https://www.ltonetwork.com/use-cases/

- LTO Network Developer Docs: https://docs.ltonetwork.com/

- LTO Network Staking Guide: