Staking LTO and Leasing. Node guide.

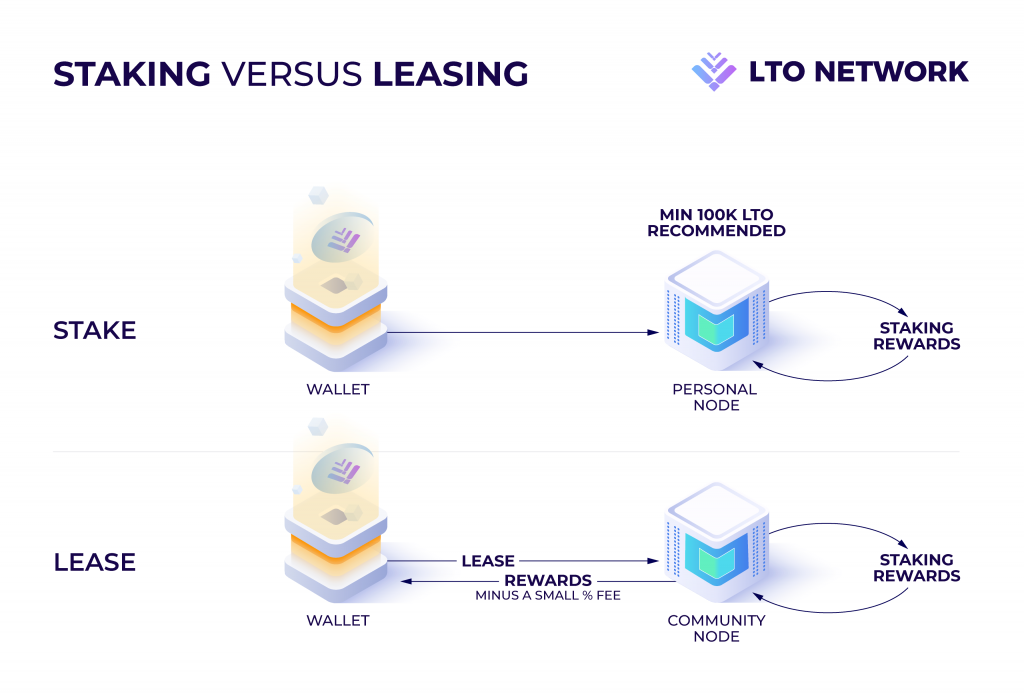

In this article, we aim to explain how any holder can support and secure the network and be rewarded for it by the Leased Proof of Stake algorithm. Yes, you can run a node and stake LTO. But if you are not tech-savvy, you can just lease to another node, which is like delegating. Staking guide ahead!

For the simple guide on how to lease - click here.

Public chain with PoS algorithm

"Coin staking gives currency holders some decision power on the network. By staking coins, you gain the ability to vote and generate an income. This is quite similar to how someone would receive interest for holding money in a bank account or giving it to the bank to invest." - TrustWallet

LTO Network has a hybrid architecture - but this article is not about the deep technical overview - that you can learn from here. What interests you in this context is the permissionless public chain part of the architecture, which is our decentralized settlement layer for notary type transactions. This is where the LTO token utility and the economic model take place, so let's focus on that.

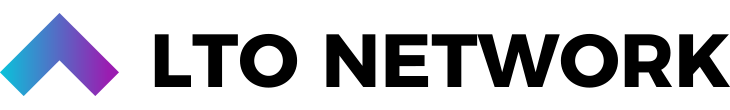

The permissionless public blockchain of LTO Network is similar to how Bitcoin and Ethereum work. But instead of Proof of Work, LTO Network is based on a variation of a Proof of Stake algorithm - and it's also non-inflationary.

Non-Inflationary Leased Proof of Stake

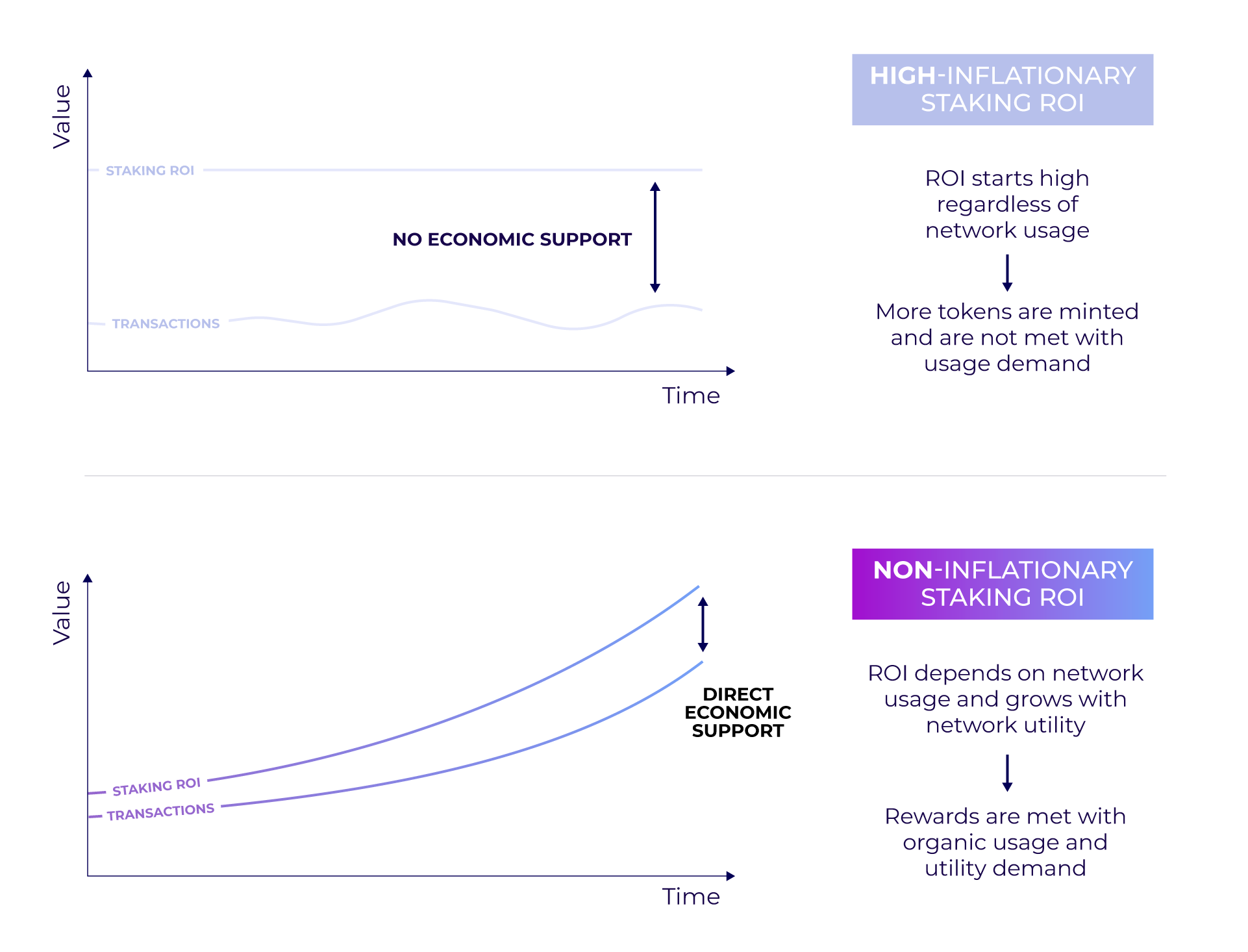

Node rewards are the transaction fees on the network corresponding with the ratio of your staked amount over the total staked amount. So if you stake 1% of the total network, let's say you stake 1M LTO out of 100M LTO, then you get 1% of the fees on the blockchain over a period of time. Pretty simple!

You can check the calculator here.

This also means that the more community and team work is done - bringing system integrators and clients to adopt the blockchain - the more real value capture occurs for the network and the LTO token!

Know-How on Leased Proof of Stake

- There is no network inflation, mining rewards are the transaction fees paid by network users. They can be coming from normal transfers, but around 99% of them are anchoring transactions resulting from clients and integrators using LTO Network products and integrations. See the explorer.

- While 1,000 LTO is the minimum requirement for running a node, it will likely not yield frequent rewards. Check the calculator to see what you can expect to get. At this point, over 100,000 is recommended.

- Public blockchain is based on the NG protocol. This means the rewards are 40%-60% split between the miners of micro blocks and a key block. So don’t be confused if you see your rewards being 0.10 LTO or 0.15 LTO.

- LPoS somewhat leads to the centralization of a network, which is why we will be switching t0 our own model: Leased Proof of Importance. The reward split would then account for actual network usage. See the detailed token paper.

- The Bridge Troll fee when entering mainnet is 10 LTO, gets split as 6 – 4 LTO. This adds some more rewards for the nodes.

Staking is only on mainnet. Swap your ERC-20 or BEP-2 via the bridge.

Tech-savvy: run a node yourself and stake

The node setup fits in a tweet, it’s super simple to set up!

1. check system requirements, which are very low

2. git clone github.com/ltonetwork/lto-public-node

3. vim docker-compose.yml

4. docker-compose up

Done! You can ask in the Tech Chat if you need help. Also, you can set up a node in a cloud environment. Check Developer Docs for the full information.

Not tech-savvy: lease LTO to other nodes

With the traditional Proof of Stake algorithm, it is important to have a big wallet: only people with a certain amount of tokens can run a node and forge blocks on the blockchain. With Leased Proof of Stake, token holders can lease their LTO to someone who is running a node.

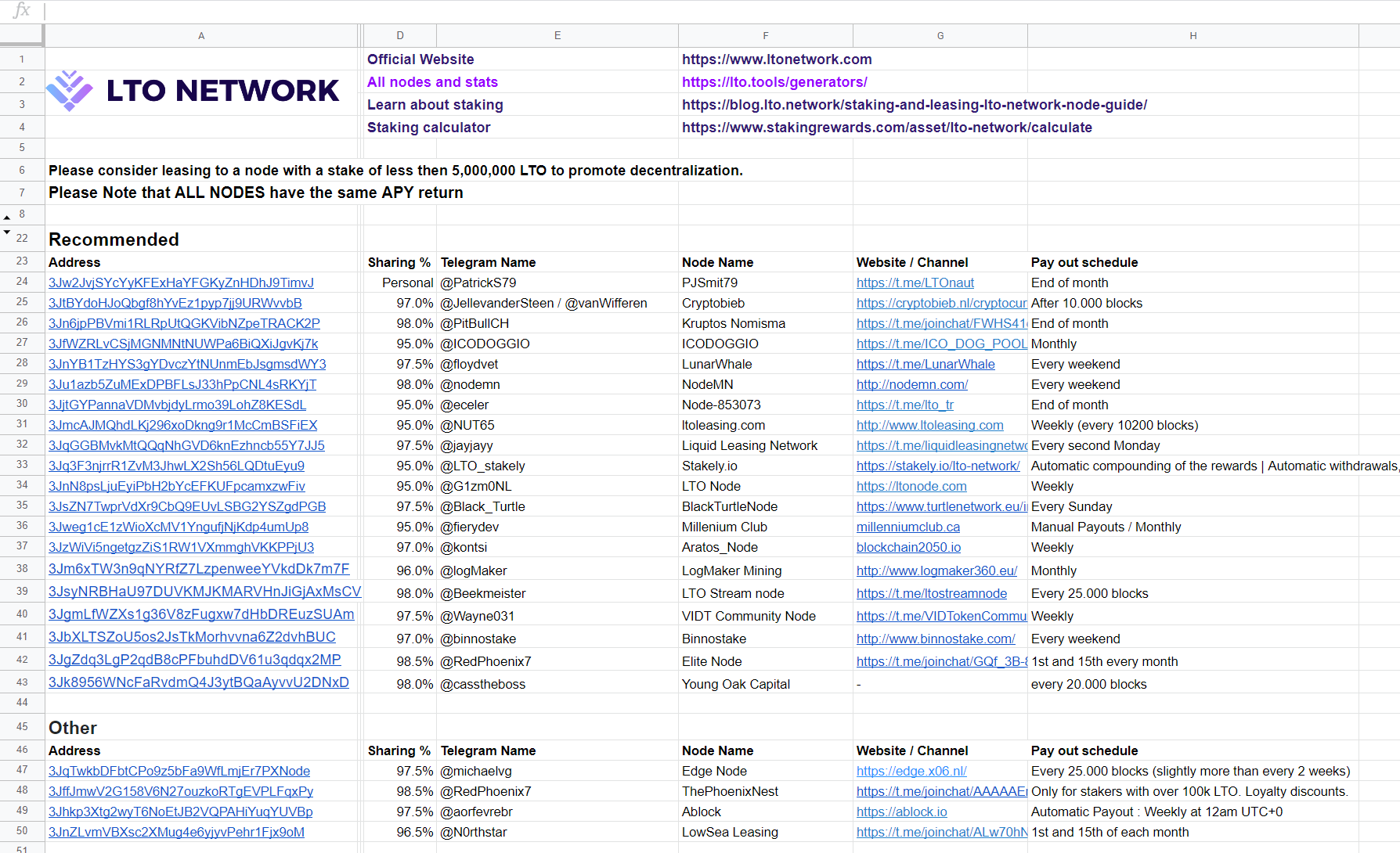

Most node operators will share a percentage of their node rewards with their leasers. The higher the leased amount of a node is, the more chance it has in being eligible to forge the new block. If the block has transactions, the mining node will earn the fees from those transactions.

When leasing, you are not transferring your tokens to someone else. Your tokens stay in your wallet. So you cannot lose your LTO this way, it’s SAFU.

- Buy LTO on the exchange of your choosing

- Create a mainnet wallet. Make sure to save your seed phrase!

- Transfer LTO to your mainnet wallet

- If the exchange supports mainnet LTO, you can directly transfer the coins to your mainnet wallet.

- In case it supports ERC-20 LTO only, you can swap ERC-20 LTO to mainnet LTO using the Bridge inside the wallet

- Read below about different leasing communities to choose from

- Go to your wallet and press lease… and you are set up!

Every node is like its own miniature community, it’s awesome! Check out different node operators, chat with them, and see who you like to join.

Website | Telegram | Twitter | Reddit | LinkedIn | Documentation