Tokenomics Update

Never before have blockchain transaction fees been such a relevant topic as today. With Ethereum gas fees having gone through the roof, other blockchains like Binance Smart Chain and Solana have emerged, as they require less fees.

The LTO team and community came together during a town hall meeting to discuss how our tokenomics could be improved. By changing the tokenomics, we aim to:

- Improve the APY for staking on our mainnet.

- Provide competitive and stable transaction costs to attract more clients.

During the community meeting, a number of options and variants were discussed, resulting in a solid plan to achieve both goals.

TL;DR

The new tokenomics model resembles the model of Solana. For each block, a certain amount of tokens are minted. This amount will decrease over time. Minting is offset by burning transaction fees. 50% of the fees are burned, the other 50% are given as mining reward.

Tokens will be locked for 3,000 blocks (approx. 2 days) after ending a lease. During this period the tokens can't be spent or transferred, and do not count towards staking.

Transaction fees are stabilized with regards to the token price in USD. Nodes act as oracles, voting on increasing or decreasing the fees when mining a block.

Staking

Staking on the LTO Network is an area where we had numerous requests asking for more opportunities. Our view is that staking is symbol of belief in the network by the holder and their belief is rewarded with coins and we have updated our models to reflect this.

Currently, 90M tokens are being staked. That's about 30% of the circulating supply. Other projects typically have between 60% and 80% of the circulating supply staked. The aim of increasing the APY is to double the amount of tokens being leased to approx 200M LTO.

Block rewards

Each block, a certain amount of LTO is minted as a block reward. This reward is provided to the node that mines the block. This is added to the rewards from transaction fees.

Initially the block reward is 35 LTO. This amount is decreased linearly to 10 LTO over 2.5 million blocks (5 years), which is 0.00001 LTO per block. With 500,000 blocks per year, this approximates a disinflation rate of 20%.

The total amount of tokens minted will be approximately 70 million LTO over 8 years (4 million blocks). Note that is not the actual rate of inflation, as it doesn't account for tokens being burned.

Maximum supply

LTO will have a fluctuating total supply. The maximum supply is fixed at 500 million. Only tokens that have previously been burned may be minted. Consensus will be adjusted to use the amount minted at genesis as the absolute maximum.

If the maximum were to be reached, the minted tokens would be equal to the burned tokens of the block. In effect, this would be the same as block rewards without minting or burning.

The current total supply is 400,000,000 LTO. In theory the remaining 100,000,000 LTO could be minted in approximately 14 years. However this would mean that there wouldn't be any transactions or any other token burn.

We do not expect that the maximum supply will ever be reached.

Transaction fee burn

The burn rate will be changed from a fixed 0.1 LTO per transaction to 50% of the transaction fee. The other 50% is rewarded to nodes for mining a block.

The effective inflation (or deflation) depends on the number of transactions. With 10 LTO minted per block, at least 20 LTO per block needs to be spent on transaction fees to become deflationary.

To calculate the inflation we're using a projection of 30% growth year over year, plus initially an additional growth of 5M LTO yearly.

With an average transaction fee of 0.1, using this projection takes roughly 6 years for the amount of burned tokens to exceed the number of minted tokens.

This projection excludes burning tokens from using the bridge or NFT marketplace.

Using this projection, the initial inflation rate would be 3.76%, decreasing to 0% in 6 years due to disinflation and transaction burn. After that inflation turns into deflation due to the increase in number of transactions.

Bridge burn

For every bridge transaction, the bridge automatically burns 8 LTO. This is done by sending LTO to an inaccessible address. With the update, the balance of this account will be void. It will also be impossible to use this account in the future.

To burn tokens, a Burn transaction type is added. Tokens that are burned will simply be gone, similar to fee burn. This transaction type will be used by the bridge.

The bridge holds LTO mainnet tokens that have been burned on the Ethereum blockchain as ERC20 tokens. These tokens will also be properly burned by the bridge.

In the future we're planning to incentivize more burning of LTO tokens. The first example - the method to list a project on the NFT2.0 marketplace, where the order of listing is decided through burning tokens.

Estimated APY

As a proof of stake network, the block rewards of a user directly depend on the amount of LTO that is held and staked (or leased). The APY describes the reward in relationship to the amount of tokens held.

LTO Network doesn't have a fixed or guaranteed APY. Nodes are competing to mine a block. Leasing LTO to a node, increases the node's likelihood of mining a reward, where each mined block yields a reward. Those rewards are shared by community node operators among all leasers.

The yield that can be expected for a leased/staked amount depends on the total amount of LTO being staked, as well as the number of transactions.

Lease unbonding period

When tokens are leased, they can't be transferred or spent. However, currently they are available directly after cancelling the lease.

We'll be asking for more commitment by introducing a delay of 3,000 blocks (2 days) after ending a lease. During this period the tokens are still locked. However, they're not contributing towards staking and thus not to staking rewards.

Spreadsheet

Transaction fees

Currently nodes can set the minimum fees they accept when adding transactions to a block. However in practice, LTO has a fixed fee for each transaction type, as all nodes use the same minimum values.

With a fixed fee, the costs for clients rise as the token price increases. This means clients with running projects might need to purchase more tokens at a much higher price. In addition, for new projects it's difficult for integrators to give a clear indication of the running costs.

To stabilize the costs, the transaction fee will be determined as part of the consensus algorithm. Nodes will vote on adjusting the fees based on the current token price. As the token price increases, the fee is decreased (and vice versa).

With this change, the incentives of all tokens holders, regarding the token price, are better aligned. Clients directly benefit from a higher token price, as they can do more transactions for the amount of tokens they hold.

Fee voting

When mining a block, a node is able to vote to increase or decrease the transaction fee. One vote can be cast per block. To vote for the fee to increase a +1 vote is cast. In case the node votes for a fee to decrease, it will vote -1. If a node does not want the price to change or does not vote, it counts as a 0.

The duration of the fee voting period is 1,000 blocks (approximately 16 hours). At the end of the period, the total of all votes is calculated. In the event that the sum of all votes is +600, the price will increase by 10% (fee * 1.1). With a sum of -600, the price will decrease by 10% (fee / 1.1).

LTO will provide a script as part of the docker of the public node, in order to vote based on the current token price. The script will fetch the price from CoinGecko to determine the current fee in USD. It compares the fee to a target price and directs the node to vote accordingly.

Effectively nodes will act as oracles to stabilize the fee. However, nodes are free to vote however they want. The can set their own target price or do not have to use the script at all.

Batch transactions

Multiple transfers can be combined into a single mass-transfer transaction. This is an example of a batch transaction, which can be used to reduce transaction costs.

Batch transactions have a base fee, plus a fee for each sub-transaction. The fee of the sub-transaction is lower than that of individual transactions. Only transactions of the same type can be combined. A batch transaction can contain a maximum of 100 sub-transactions.

In addition to the mass-transfer transaction and the new register transaction, the mainnet upgrade will also allow anchoring to be done as a batch transaction.

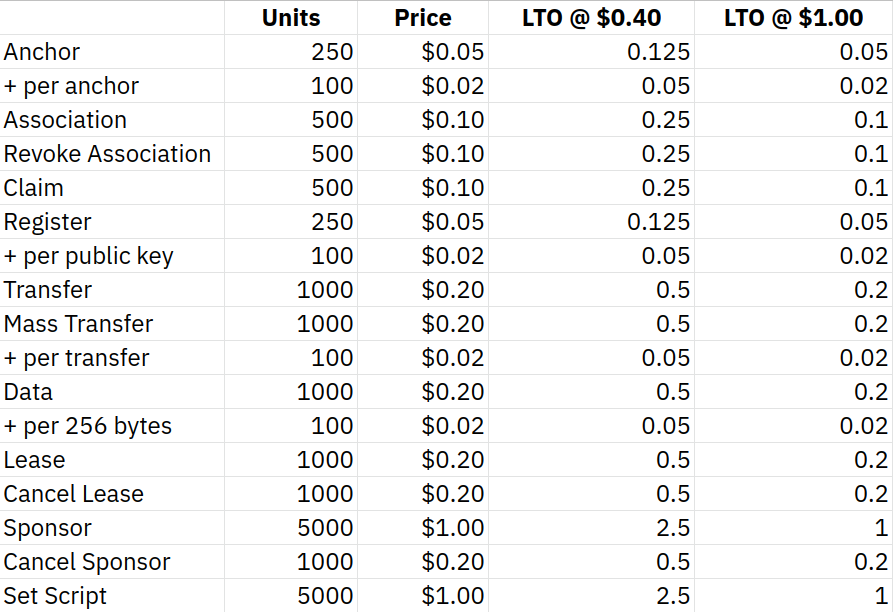

Fee prices

The public chain defines the fee for each transaction type as a multiple of the 'fee unit'. This unit is currently a fixed value of 0.001 LTO. Fee voting will increase or decrease the value of the fee unit in LTO.

Voting is done based on a target price for a transaction. This target is not hard coded and may be configured by each node operator independently. The default value is determined by the team in collaboration with clients, integrators, and node operators.

With the upgrade, the price of association and claim transactions are reduced from 1,000 base units to 500 base units. For other transaction types, the number of units will remain the same.

The default target price of the base unit will be $0.0002. This results in the following target fee price for each transaction. The table also contains the transaction fee in LTO for a token price at 40 cents and 1 USD.

An anchor transaction with a single anchor hash will cost 7 cents. A transaction with 5 hashes costs 15 cents, resulting in a net cost of 3 cents per anchor.

Consensus based fees

For every transaction the sender offers a fee. The fee is part of the transaction data that's signed and broadcasted.

Currently the fee, as offered, is deducted from the wallet of the sender (or sponsor). If the offered fee is lowered than the minimum required by the mining node, the tx is rejected.

{

type: 15,

version: 1,

id: "8ALYzb7oxgFmGDPZo2YNDsYVZMRXVS3wYoPiqLj7bKHd",

sender: "3JkmVLsNYRpNfFPiqoymUm6EuW5FrL6rRrG",

senderKeyType: "ed25519",

senderPublicKey: "D6Uk4rP6jRxCbg88Bup5eLG3KQc3Qfvp43NMvr8YBjog",

fee: 35000000,

timestamp: 1651575897188,

anchors: [

"3KqzDaZHRvNNfzi4SAFM3tGbwYdk5qniyLZmA7VExdUa"

],

proofs: [

"ombcuVbD7Kx55g5M8LtCaTPsnEahxqg7KAFRrBdy78SRmp5PKDL7LP..."

],

effectiveFee: 35000000

}

After the update, only the fee as agreed upon by consensus will be decucted from the wallet of the sender. The fee property of the transaction is used as maximum fee. The actual fee that's paid will be returned as effectiveFee.