One week into the LTO V2.0 Deflationary Fee Burn Token Economics.

As many within the community are aware. The LTO V2.0 Deflationary Fee Burn Token Economics proposal won the majority of the votes at block 860,000 and was officially activated on 28th of August at block 870,000 on the LTO Network.

What’s happening right now?

As proposed, the transaction fee increased from 0.25 LTO token per transaction to 0.35 LTO token per transaction with 0.1 LTO token being burned in order to achieve the deflationary token economics. In case the price per LTO token grows exponentially and goes up too high, the network will be able to vote for the fee reduction, with the burning either adjusted or staying the same. This is a dynamic feature.

So far ( 4th of September 2020) 30,000 LTO have been burnt in the first week since the mainnet update. These numbers are only going to increase in the future, as transaction activity grows due to confirmed usage and the launch of new use cases.

What does this mean for LTO and LTO token holders?

The current setup and situation is favourable for token holders. Why?

The steadily increasing transaction activity growth means that more rewards will be distributed to stakers. Additionally, the continuous token burns will further decrease the circulating supply, causing scarcity and increasing the value of LTO tokens.

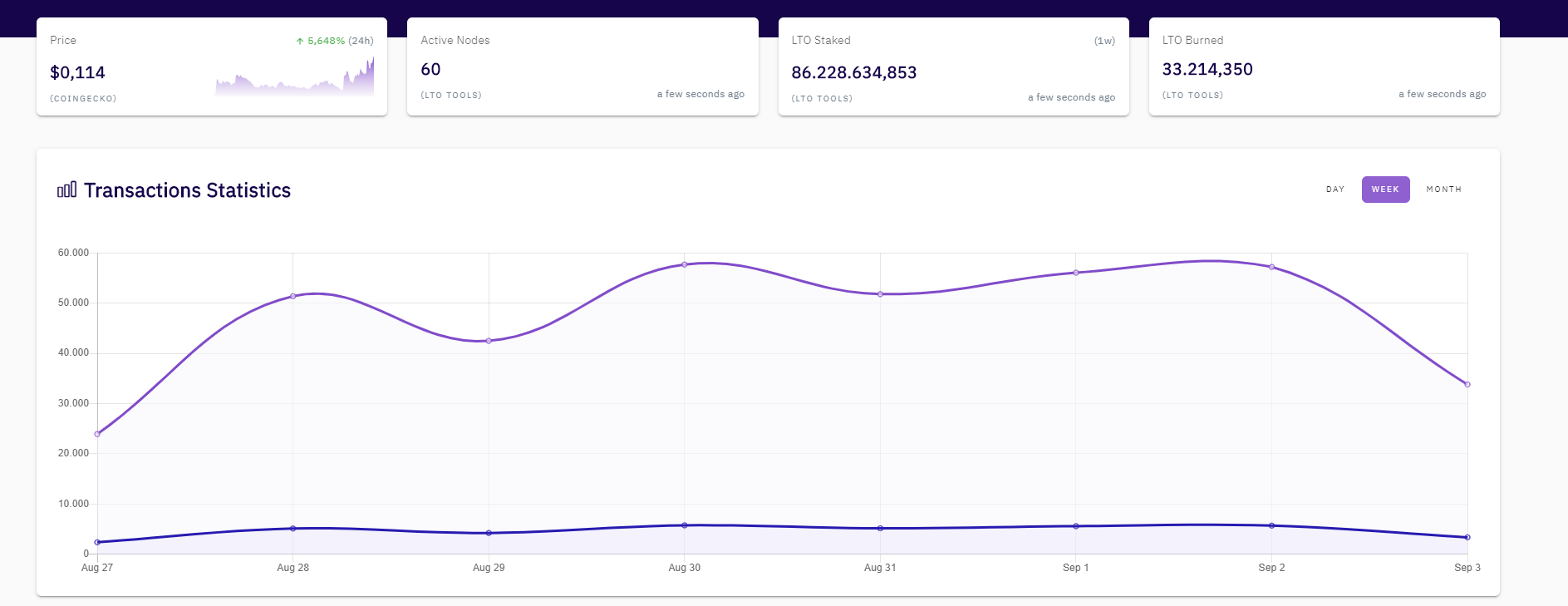

Currently, a total amount of 90 million LTO is being staked, while roughly 151 million LTO are in circulation and being traded on the exchanges. Transaction count has been growing at a good steady rate, only taking a hit in Q1 2020 due to the COVID-19 pandemic. Currently, LTO Network handles over 50,000 daily transactions, with a current all time high of 63,000+ daily transactions. As new use cases are onboarding and already present use cases expand, we expect activity to grow. Based on the pipeline of use cases going live, the daily transaction activity growth is expected to be at least doubled towards the end of Q4 2020 compared to the start of the year. The amount of burned LTO will increase accordingly. This means that the circulating supply of LTO on the secondary market will decrease over time as well.

Updates about the Explorer and Web Wallet

The team upgraded the Explorer with a new display to show the amount of burned LTO. If all goes well, we’re looking to optimise this within the next couple of days. There will also be a monthly recap on our social media platforms showcasing the total amount of burned tokens at the end of every month. The team wants to create a transparent environment where the community has a clear overview of the supply and amount of the completed transactions.

Although everything works just fine at the moment, those responsible for the explorer are constantly looking for improvements. We’ve received a lot of valuable feedback from the LTO community and there will be some major updates around the Explorer and the Web Wallet in the next couple of months.

Updates that are currently being planned:

Independent web page for token distribution

- Display of total supply

- Display of average of total staked tokens in 30 days

- Display of total burned tokens

- Display of a list of available community nodes for leasing

- Display of estimate % of ROI

- Display of token distributions on each network (LTO, ETHEREUM & BINANCE)

- Display of wallets of top LTO holders

Updated LTO Web Wallet

- New UI (more user friendly)

- Updated LTO Network logo

- Adding contact list

- Adding available and verified public nodes for users to lease to. Think: simple dropdown menu with community node names