Governance improvement: burning 50M LTO from the foundation, 11% of total supply

Projects in 2018-2019 abused one-off token burns for the sake of short market spikes. Our decision is not of that nature. It carries two logical reasons behind it, related to governance. Let's dive in.

Respecting LTO blockchain's growing value

As LTO Network mainnet has been live since January 2019, the usage has grown to the top-20 most used blockchains. It's not just a concept or a pilot chain, it has real-world usage. There is now more value captured on-chain:

- B2B integrators who hash events and timestamp pieces of digital data like certificates, digital signatures, workflow steps;

- Stakers who secure the network with over 52M LTO in total, which is around 25% of the circulating supply valued at over 2,000,000 USD;

- 2 large network upgrades (summer 2019 and spring 2020) which had new features implemented, and solved some of the bugs present before.

There is actual necessity to make sure the network has proper governance and token distribution in place. This means there should be no one party that can easily obtain 51% of the staking power.

The trend we have observed over the past 2 years of teams and foundations controlling too much of the supply is not healthy. Especially when it concerns Proof of Stake networks, where correct token distribution is vital for PoS networks' security. We want to improve that.

Maintaining high network security

The public blockchain of LTO Network is not controlled by anybody.

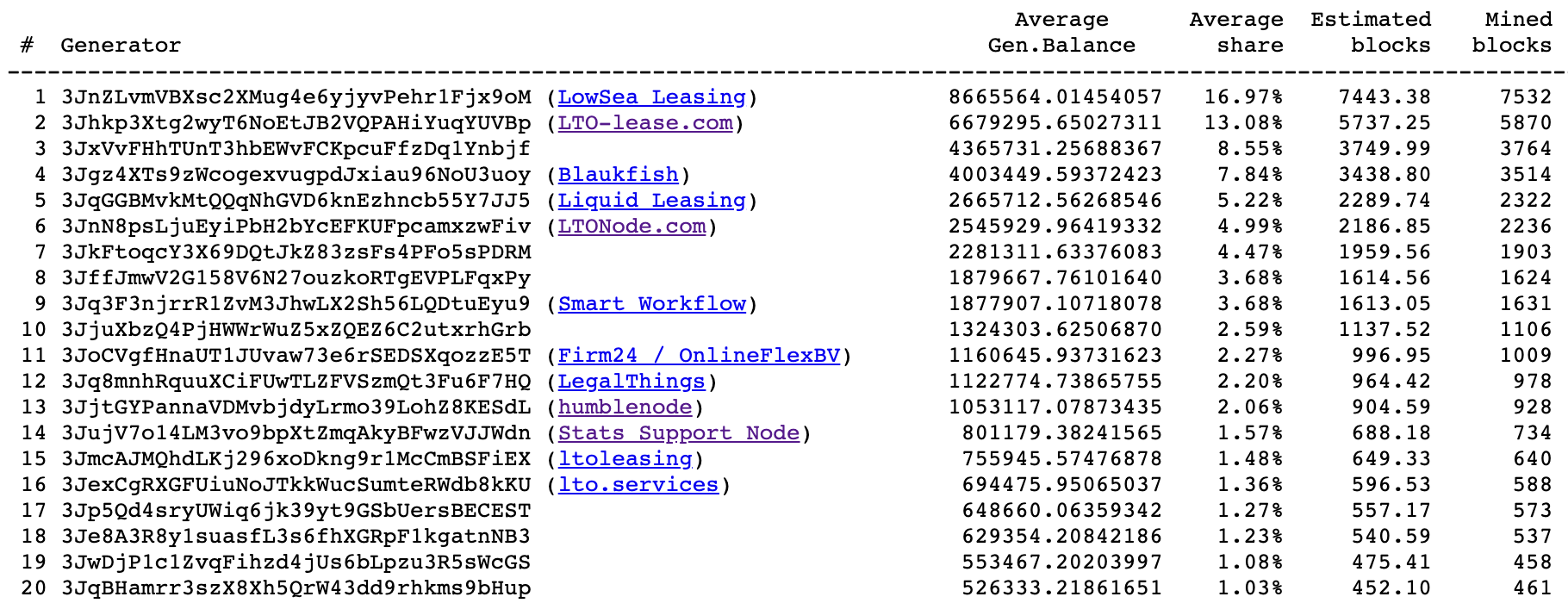

There are only 6 team bootstrap nodes out of 95 in total, which shows great community participation. This has been the average number over the past few months, staying stable within +/- 7 range.

Keep in mind, unlike some other networks, there is no unhealthy subsidy to run nodes. In fact, a sheer number of nodes quite often is irrelevant. What matters in PoS chains is the token distribution. In most cases, like for LTO Network, it is related to having over 51% staking power.

At current time, there is no staking power concentration in one hands. The bigger nodes are staking pools. There is a whole discourse one can get into with regard to delegation and voting consequences, however, LTO Network holder base is very active when it comes to governance decisions.

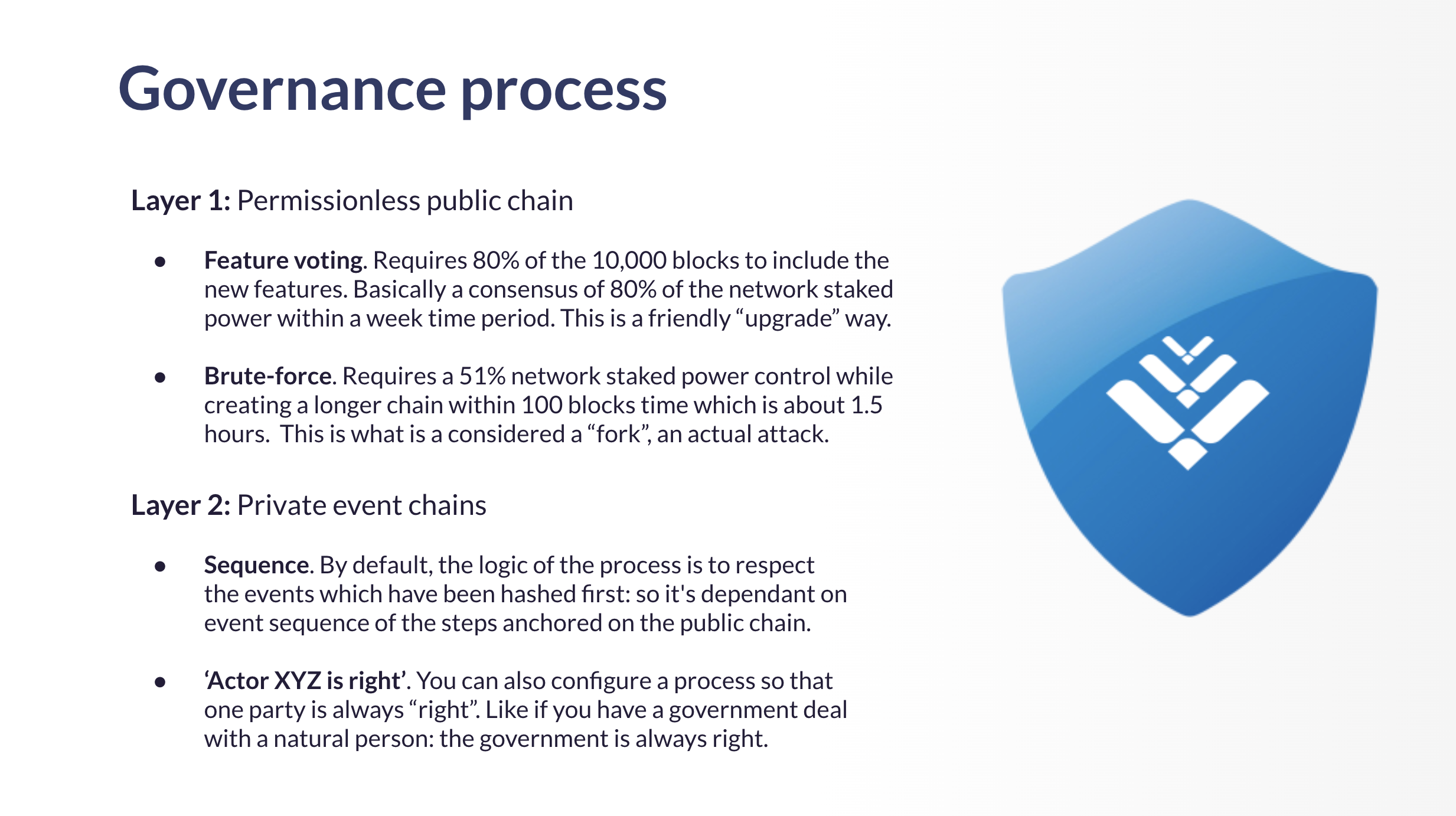

Governance is a topic that has been widely discussed since the beginning of the blockchain / crypto industry. For the hybrid blockchain like LTO Network, governance comes in various forms:

Improving token distribution: foundation burn

The 51% power largely depends on token ownership. Of course, one can talk about staking derivatives, lending, and other types of financial services disrupting that equation - but for now, it's plain simple.

We previously kept the Foundation's 50M to vote for major decisions happening on the network. They were supposed to be never moved and never enter circulation. But we have never utilised them and don't see ourselves ever using that supply to vote.

So for the total supply, it's more healthy to get rid of this part.

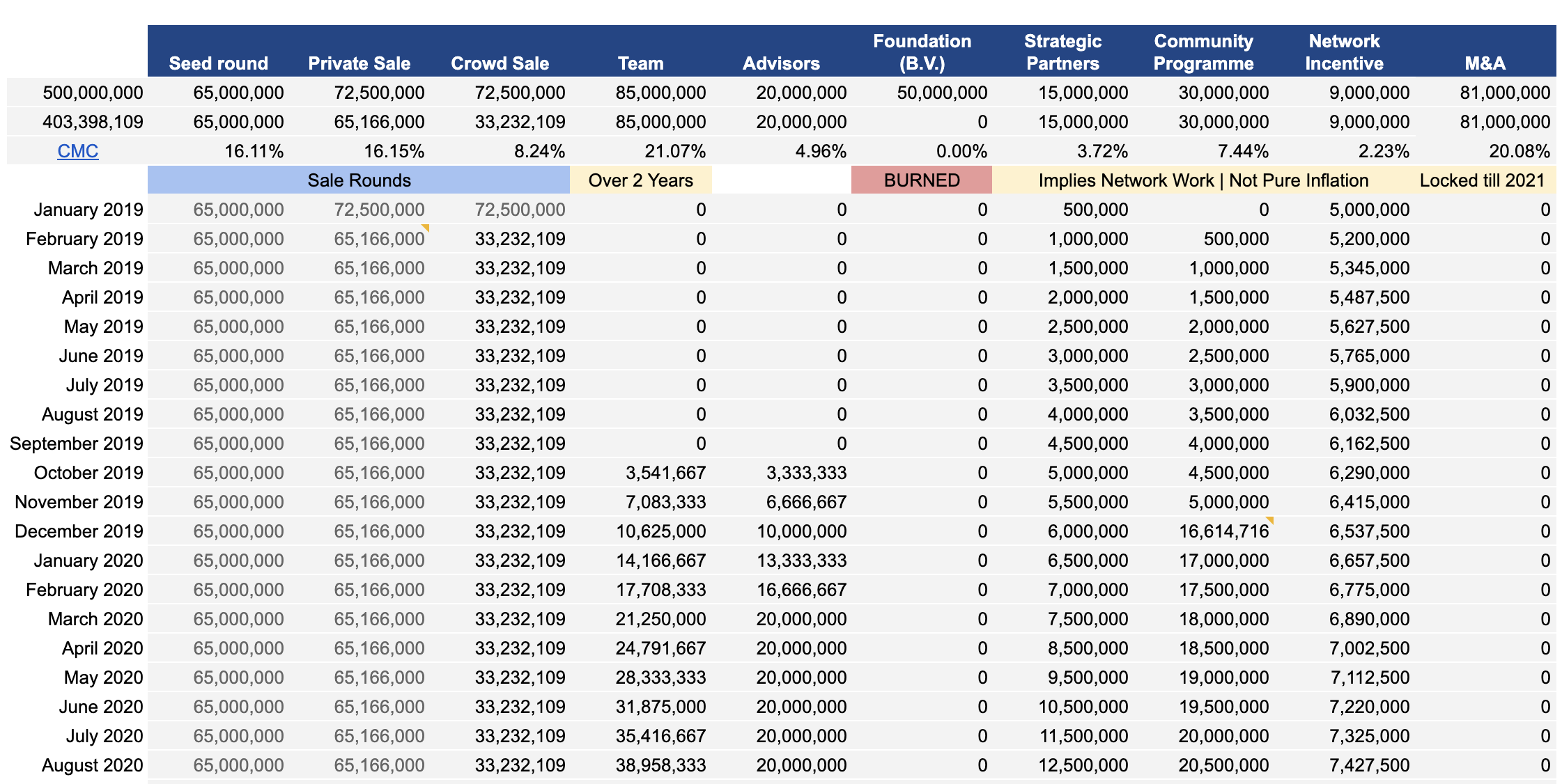

In fact, the majority of the supply has been in circulation since 2019, and only the team wallet which has never been touched, is under gradual unlock. The community incentives supply has been releasing very slowly and is related to cool marketing activities. The M&A wallet is not touched till later in 2021 and can only be used for inflationary purposes.

See the updated transparency report:

The steps we have taken:

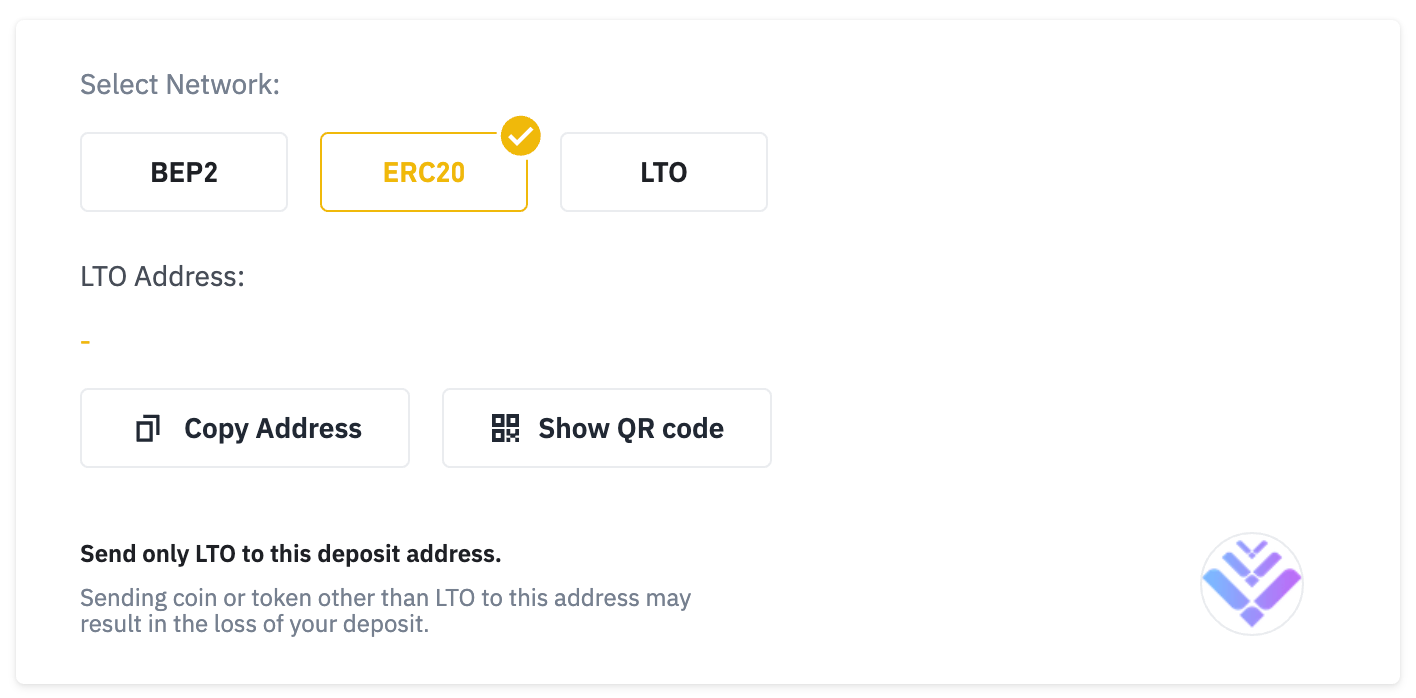

- 50M LTO transferred over the bridge from the Foundation mainnet wallet to our Binance account: https://explorer.lto.network/transactions/E2W3kPRHwQdPjX5eVmXJkxRyCHu6Re8p7qwZweBMdqit

- 50M LTO withdrawn from Binance to our temporary Ethereum wallet: https://etherscan.io/tx/0x8fd8a60082e950298f49382d3b25012809cb0aa119e6cb15c8f328b901ea2fc6

- 50M burned from our temporary Ethereum wallet: https://etherscan.io/tx/0x191ea08e95f9e87d7611ffe6c624be5a5ad82f390e2f77c22bb2ee516850a3a9

This means that the total supply has forever been reduced to below 404M LTO. In fact, with the upcoming token economics upgrade, the asset might actually become deflationary.

With over 211M LTO already in full circulation out of 403M LTO, that marks over 52% of the forever total supply circulating. Considering that over 100M of the remaining non-team supply does not actually belong to anybody, the percentage of token supply centralization is even lower.

Coinmarketcap and Coingecko should be updated as well.

This makes further governance questions related to mainnet upgrades more fair to the participants involved, and the overall network security higher.

Further steps: Binance supporting LTO mainnet

Wait what, Binance mainnet support?

Yes! All three chains which LTO tokens exist on, have been added as deposit and withdrawal options on Binance.com. Since the use of the bridge would have been an extra step in the process, the "recycling" of Foundation tokens actually replenishes the reserves of Binance on the mainnet side. Win-win.

Announcement: binance.zendesk.com/hc/en-us/articles/360043989332

The tokens were deposited on Binance from the mainnet side, but taken from the Ethereum side. It basically makes the token holdings on Binance more balanced and allows to service users on different chains. An alternative to the existing bridge if you prefer to interact with Binance instead of the LTO bridge.

More power to the users!

There is no requirement to swap, all three chains will be supported. But if you want to get rewards by supporting the network, then join staking!

We have been working on a new token economics proposal, learning from how #DeFi protocols (like @AaveAave $LEND and @KyberNetwork $KNC) managed to successfully capture value. That would require a mainnet upgrade. More details later in June!

— LTO Network (@LTOnetwork) June 1, 2020

Some context on the current outlook: pic.twitter.com/ILFgYLg1py

We are working on improving liquidity and trading conditions overall, as well as the token economics. Stay tuned for the upcoming stages on the mainnet upgrade later in June, and while you are at it - join us around the web:

Website | Telegram | Twitter | Reddit | LinkedIn | Documentation