Our Vision: Blockchain Trends 2020 for organizations and businesses.

What is blockchain for: privacy coins and programmable payments, data security and decentralized storage, or something completely different? As with any new technology, it can be applied in various cases as long as there are users who see value in it.

At the beginning, it’s obviously not so apparent what, how, and where it will be used. So a lot of things are being tried, in an attempt to find where the technology would stick. Like drones. Drones delivering packages, drones delivering people, drones filming videos… Mmm, maybe not all of these make sense. And the same holds for the blockchain technology.

Creating value instead of just hype

It turned out that your coffee cup doesn’t need a smart contract, wow! But you can benefit from smart contracts in DeFi. You can also increase the security of your data with the help of other blockchain features. That's where things make sense. As long as there are users who see value in it.

But this article is not to give you predictions on Bitcoin cycles and tell you when to finally execute your Cybertruck pre-order. It’s a reality check.

In 2018, we posted our Visionary Paper where we outlined how we see the blockchain space develop further. Now, almost 1.5 years later, we look back to what we laid out at the beginning and what we are doing differently now.

We will talk about how we see the market, what our partners experience, how use cases actually go live, and what approach we see is best for LTO Network to grow.

We share the Web3 vision, but see a different path to its adoption.

If we assume that the WWW has revolutionized information and the Web2 revolutionizes interactions, the Web3 has the potential to revolutionize agreements and value exchange. It changes the data structures in the backend of the Internet, introducing a universal state layer, one by incentivizing network actors with a token. - BlockchainHub Berlin

Firstly, let’s set one thing straight. LTO Network is not about payments, smart contracts, or DeFi. Also, no oracles, no trading, no assets. We do not compete or infringe on the financial transactions side of the blockchain technology. Our focus and applications are in a different segment, and are actually complementary to other solutions.

What the hell do you do then? - You might ask.

LTO Network is for organizations: the new standard for data security and collaboration. Data management, data security, data re-use, document management, internal and external workflows, connecting systems - that’s what we do. All our products are in line with this type of solution and our market solely focuses on the organizations that are facing this problem.

There are amazing developers and teams working on research and disruptive applications. For instance, here is a cool thesis by Fabric Ventures on the evolution of the Internet and cloud specifically. Multicoin Capital has a cool vision on the development of assets as well.

We share the Web3 vision, but see a different path to its adoption.

Let’s look back into the Visionary Paper of 2018:

"There is no lack of great blockchain projects. But all of them seem to suffer from the same problem; little to no adoption. Can it be that the blockchain is a solution without a problem? Despite an abundance of task forces and working groups, organizations are struggling to figure out where the actual strategic business value for them lies".

There are more pilots, more use cases going live, more developers joining the ecosystem on a permanent basis. This is a positive trend. The industry is developing outside of the echo-chamber. The industry of the blockchain technology, not assets only.

Where do we start with blockchain? Its short-term value predominantly lays in reducing costs and increasing efficiency for incumbent organizations. Change both within an organization and within society often provokes resistance. To counter this, we should initially focus on low impact solutions and progressively introduce more significant implementations.

Still holds true as well! Let's see this in practice.

Adoption strategy: land & expand

We start with simple things, like data anchoring, which can be applied to all existing applications and increase the security of any piece of digital data. Once a system integrator sees the benefits in practice, they are able to upgrade – all within the same environment.

Ok, enough of abstract stuff! Onto the reality check.

In 2018, we set out to help drive blockchain adoption in the following timeline: from the most simple use cases, to the most complex ones, over a few years.

1. Added security for existing applications

Yes, this is well in production. Anchoring, simply hashing data pieces on the blockchain, has been the go-to solution for digital signatures. Anything that requires a trustless Proof-of-Existence verification can benefit from anchoring. The benefit here is that it’s very simple to integrate into centralized systems and is perfect for stage 1 products.

2. Public key authentication

This one is in development and will be released in 2020. The idea to use associations and dynamic chain of trust can be combined in centralized applications, while in the back everything is verified with the blockchain. Our new product Proofi will be taking advantage of this feature.

3. Verifiable certificates

This one is also in development, and even more so - already has future applications. We are doing Live Certificates with NEN, and further with the Den Haag University. It’s fairly simple from the technical perspective, but has major benefits in practice. The perfect combo when it comes to adopting new technologies and pushing through integrations.

4. Decentralized workflows

The documentation has been released. As part of our adoption strategy, parties will be upgrading from stage 1 to Live Contracts. The level of adoption is still pretty low here but the potential and benefits of “breaking out of data silos” is incredible.

5. Self-sovereign identities

We have developments here, but the space itself is not that far yet, as anything related to identity on a government level is extremely hard to implement. Hyperledger and Sovrin are working on solutions together, and there are other startups exploring authentication systems.

6. Tokenization and 7. Trustless financial products

The last 2 are actually what LTO Network is not directly doing at this moment - those are really the disruptive technologies which we envision to come into play in a number of years. We can facilitate the process of tokenization, KYC procedures, and so on - but not the financial transactions themselves. Look up at the “What LTO Network is not” for more clarity.

Overall, the progress has been great, and we are just starting!

The DeFi space has been absolutely the biggest narrative and Ethereum application of 2019. Going under-collateralized is still a big question, but the progress has been astonishing.

Next to that, there are projects working on unlocking the financial value in shipments like Centrifuge, storage by Arweave, staking derivatives by Stafi, encryption by NuCypher, Layer 0 scalability by Marlin Protocol, privacy by HOPR, DAO experiments by Moloch DAO, and so many others - we don’t even need to mention leading teams like Kyber Network, and so many others!

Blockchain Trends 2020 for organizations

This is a summary of the thoughts that we have explained in this article. Keep in mind, those 3 do not apply to non-organizational applications. If you love crypto-anarchy, this is not it. But this is what we believe to be the driving force to actual blockchain and crypto adoption - and are already executing on it!

By the way, if you need our help, reach out to us any time!

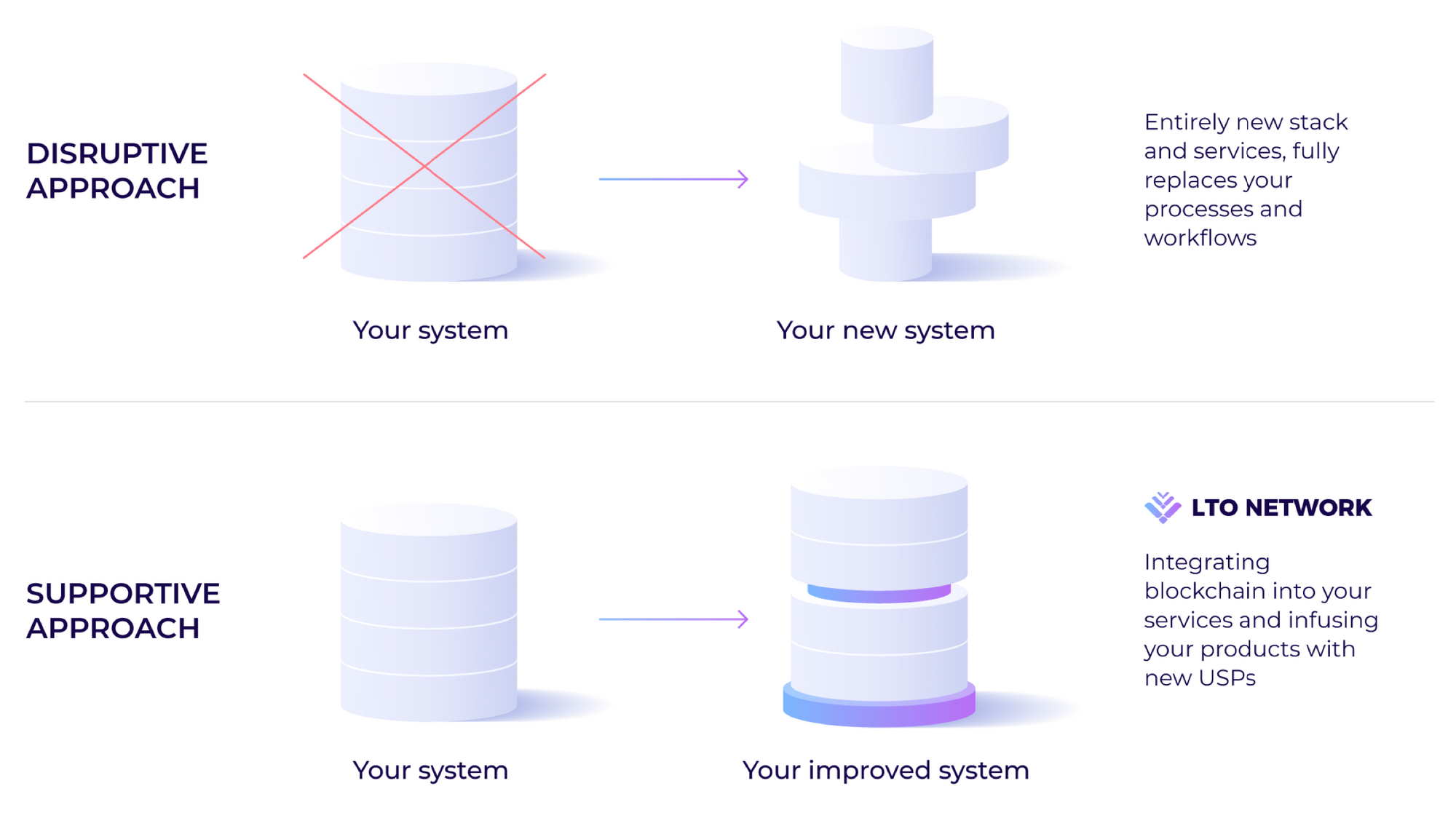

Blockchain not as disruptive -> blockchain as supportive

The benefits for cost-savings, paperwork reduction, and data re-use that the blockchain technology offers - are becoming more clear to organizations. But they want to start small and not change their entire systems right away.

Therefore, we already see and expect to see more existing systems to use blockchain technology in the backend. Starting slow and small on condensed processes and then upgrading gradually to more complex workflows and systems.

Not just private or public blockchains -> hybrid blockchain

Hear us out on this one! We are not talking about hybrid blockchains for money transfers, oh no. Those must be public ledgers. But when you talk about data sharing and process optimization - neither only private nor only public works.

It is a mix of “I want this data private - but also verifiable” which is why we built LTO Network in the first place. Without going too much into detail in this article, you can check the website for an overview of the stack. We see the hybrid blockchain approach as beneficial as a way to optimize systems in an easy way with smooth integration.

Not battling with regulators -> compliant blockchains

Yet again, this is fully about data and workflow management, not about payments or store of value. We are not trying to infringe on the BTC narrative.

In the past years, people went from “our blockchain will kill all governments” to “hm, we need to work together”. Which is a very sensual thing if you want to achieve critical mass adoption. Illegal or grey markets can prosper, and they do have users - no doubt. But most people, and we are talking 90% and up, are not willing to get involved in that.

Conclusion

We have the utmost respect for teams that work on groundbreaking applications and use cases around Web3 protocols - we love it. But as a company, as a community, and as people who want to see those values succeed, we believe that working with enterprises first, and then make changes once our platform has grown - is the best way going forward.

We will contribute research, resources - into driving that vision forward. For 3 years in a row, we have been steadily growing, and are humbled to be getting closer to a stronger product-market fit. After all, we believe that privacy and transparency do not have to be mutually exclusive!

We have an ambitious 2020 ahead, and a lot of content planned. Check out the list of use cases we have, and browse around the website - you’ll surely find something helpful. Otherwise just ping us on any social media - we are there 24/7!

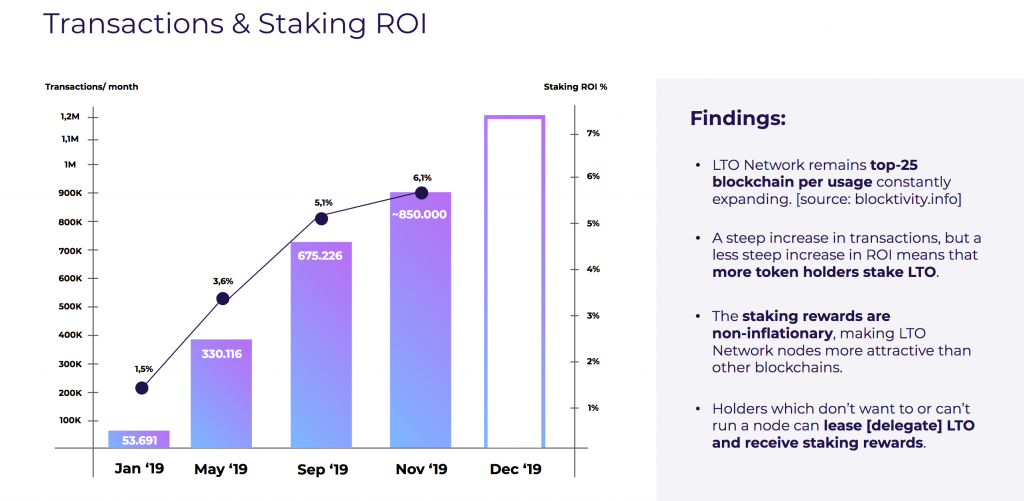

We don’t talk about LTO token in this article due to the different focus here. But keep in mind that value capture happens at LTO as a cashflow asset. The public chain helps secure the entire system, and does so due to economic rewards and incentives. We will have a separate piece on this topic later, but you can always check the papers yourself.

For more blockchain-in-business content, you can check out BCG. If you want to read into how the finance part of the blockchain is doing, then the recent visionary blogs by CZ and Brian Armstrong are the best places for that. We especially resonate with the points related to a gradual adoption approach starting with semi-centralized applications and and further shift to:

- A larger number of M&A by more sustainable projects as we have prepared token allocations for that previously as well;

- The rise of utility and cashflow assets with real value capture;

- Inflow of institutions and larger capital holders to actual blockchain use cases.

Did something not make sense? Do you have feedback, some comments, or just want to chat to us? Join LTO Network community!

Website | Telegram | Twitter | Reddit | LinkedIn | Documentation